Like many newlyweds, after the hoopla and grandeur of the engagement, parties and the glow of the honeymoon, the grit of the everyday comes into focus like an alarm chirping on a Monday morning.

It’s just the beginning of the rest of your life together.

When Nikki and Kyle got married shortly after they graduated college, they were no strangers to each other. Having been together since high school, they had been through the ups and downs and the stretching and growing in college, and yet their relationship stood the test of their turbulent early-adulthood. And now, standing on the opposite side of covenant as husband and wife, they faced a seemingly endless ocean before them: debt.

It was shortly after their marriage when they realized how in over their heads they were in debt. As they floundered under the weight of their student loans, including undergraduate and graduate school loans, they were still trying to catch their bearings with living together, figuring out bills, rent, and savings.

“My relationship with money was always fraught with tension and stress,” Nikki begins. The debt they had accumulated were from undergraduate and graduate loans weighed on her shoulders like a boulder. “Early on, we met with a financial planner who advised us to not pay off our loans.” The advisor was trying to convince them to get into a loan forgiveness program because of her occupation as a social worker. However, after praying about it together, both of them felt initially tempted, but unsettled. For Nikki and Kyle, they realized that if they didn’t pay their own debt, “our debt would have to be paid by someone else… whether that’s by the government or other people,” Kyle adds.

“We didn’t think that was fair. We took it for our education, so it was our responsibility.”

Together, as husband and wife, they made a decision to take ownership of their debt and start throwing everything they could at their loans.

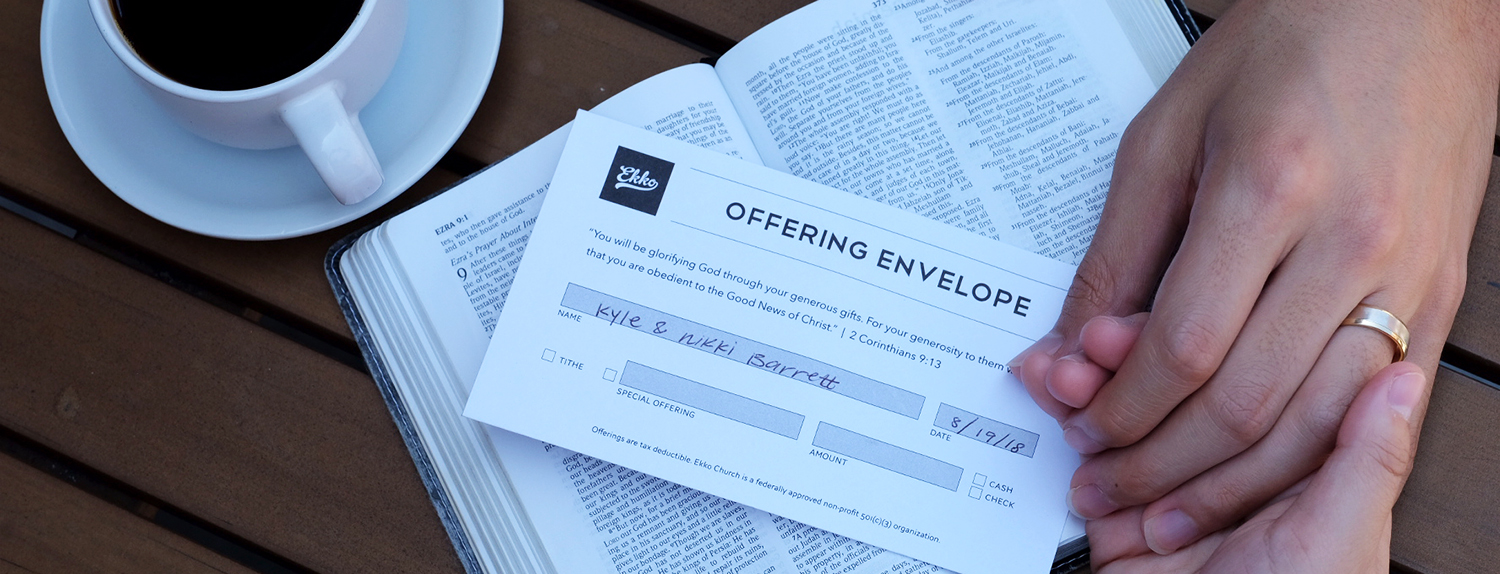

As they started to budget, pay off loans and try to save, Kyle explains how their attitude toward tithing changed. “There was one Sunday where Pastor Bryan was teaching us about the spiritual discipline of tithing. At that point, he wasn’t beating around the bush anymore,” Kyle recalls. “We had been tithing 10% of our net income, and that’s when he said we need to be giving 10% of our gross income,” Kyle says.

That day, their understanding of finances and tithing shifted.

This wasn’t about doing the bare minimum out of sheer obligation.

Tithing was about giving God what is His, and it’s about surrendering the first fruits in a posture of obedience and faithfulness.

Nikki and Kyle are the first to confess that it was hard to take that first step—especially because they had been so aggressively trying to pay off their debt. “But tithing 10% of our gross income taught us to give to God what is His, before taxes and other expenses,” Kyle continues. “It was about learning how to give God our best, our first fruits, not our leftovers. It was proclaiming that this money is not ours, but God’s.”

“Of course you think about where that money could go,” Nikki admits. “But once our perspective on tithing shifted, it started to become a discipline. We didn’t even count that 10% in our budget. It wasn’t ours to save or use for loans.” But after some time, Nikki and Kyle began to observe something supernatural at work. “I swear, against all logic, it just works itself out. When you tithe, you learn to work with what you have left,” Nikki says.

“How can we expect Him to move in any other aspect in our lives if we can’t give back to God what’s His to begin with? That’s the bottom line.”

As they prayed over their finances, they began to move in faith and obedience by tithing their firstfruits to God and by actively tackling their debt, Nikki and Kyle started to learn what it meant to trust God and His provisions, while still being responsible stewards of their finances. In their lives, they were often reminded of God’s promise to provide. “If God takes care of the fields, how much more does he care for us? Leading a full life of faith is not about convenience or ease or comfort. But when you look back, you will see the testimony of His faithfulness,” Nikki says.

Over the course of three years, Nikki cycled through many job opportunities as a social worker getting her hours. Long, arduous hours bearing the emotional heaviness and uncertainty of the next position, but as they look back, they see so much of God’s provision in and through each job opportunity. “Each job I had, each salary I was paid, God was and is our Provider. Though it wasn’t how we expected, it allowed us to get to where we are now,” she says.

They asked for a way, and God always provided.

But His way wasn’t always easy.

“There are no shortcuts when it comes to getting out of debt.”

— Dave Ramsey

One of the hardest things they had to learn to say was “no.” They learned to refrain from eating out more than once a week or buying that extra coffee here and there. When Nikki and Kyle painstakingly looked over their credit card statements, categorizing each line item to incredible detail: eating out, coffee, gas, personal shopping, gifts… “I began to realize that stuff added up so quickly where I didn’t know they’d add up,” Nikki says, “Ten dollars here and there add up so quickly, more than you think.” With little adjustments and delaying gratification, they learned to fellowship with their friends differently; instead of going out, they would invite people over and host them, and instead of buying that coffee, they would make it at home.

They often heard that they should travel and saw their peers traveling, but they realized they had to learn what they were willing to sacrifice as a family. “You have to know what your limits are. That’s between you and God and what He’s asking you to do,” Nikki says.

“No for now, but not forever.”

— Pastor Bryan and Pastor Michelle

“This whole fear of missing out is so much pressure, but it’s okay to say no. Of course, we feel that pressure too. But there are other ways to be present with people and give them your time,” Nikki says. Making adjustments and small sacrifices for the long-term taught them to be creative with how to be present and active within their friendships. “You don’t have to live under a rock, enjoy yourself to an extent. But you make adjustments, and sometimes it’s a sacrifice, but in the long run, you’ll have so much freedom. It’s so worth it.”

In the spring of this year, Nikki and Kyle wiped the last of the tens of thousands of dollars of their debt away. Though it set them back to base level in regards to their savings, it was worth it. “You could just see the freedom breaking through Nikki’s face when that last payment went through,” Kyle says with a smile. Through their faithfulness to give and by learning to forsake temporal comforts and instant pleasures, Nikki and Kyle get to experience the blessings and the joys on the other side of their obedience.

Instead of being controlled and chained by their finances, they are able to see it as a resource to be stewarded with God’s wisdom and a way to bless others. “We pray, and ask if there’s a person, place or time God wants us to give, we surrender that,” Kyle says.

“Debt, whether educational or not, is debt. When you make it a priority to steward what you’ve been given and take ownership of the money you have borrowed, I can’t tell you enough of the freedom and joy we get to live in now,” Nikki says, a broad smile spreading across her face. “When God moves us to give, and we get to participate with Him.”

“The wicked borrows but does not pay back, but the righteous is generous and gives.”

— Psalm 37:21

Sermons:

A Tenth of Everything | Pastor Bryan H. Kim (Genesis Series)

Good Enough | Pastor Janette Ok (Luke Series)

Tithing | Pastor Sam Song (Guest Speaker)

Spirit of Mammon | Pastor Sam Song (Guest Speaker)

What Do I Still Lack? | Pastor Bryan H. Kim (Matthew Series)